FAQ

Why is Real Estate a Good Investment?

Whether the stock market is up or down, we believe real estate will be steady. Real estate fulfills the universal need for shelter; Thus, it will always be in demand. We believe the best way to leverage real estate is by investing in assets that offer consistent returns over time.

It Is A Hedge Against Inflation

As economies expand, there is an increase in the demand for real estate. As infrastructure and industry grow, the value of the properties increases proportionally. The property’s value increases at a rate that is often equal to or greater than the inflation rate.

It Offers Tax Breaks

Unlike investments in the stock market, where you are taxed based on your gain, you are not taxed on the increase in the cash flow of real estate over time. Additionally, you can deduct the costs of owning and operating real estate, which will become an advantage during tax season. Suppose it becomes necessary to sell a property rather than paying a tax on the gain from appreciation. In that case, you can reinvest that money into a new cash-flowing real estate deal without paying any taxes.

Diversification

It is best practice to diversify your investments across different asset classes. Typically diversification means more steady returns over time.

A syndication is a real estate investment where limited partners and general partners share equity in a deal in an 80/20 split. The limited partners provide capital and are passive throughout the investment. General partners are responsible for sourcing the value, raising capital, and underwriting. They are further responsible for operating the property while it is in operation.

Syndications are passive. Rather than trading time for returns, your money will work for you in the real estate market. You’ll be able to partner with skilled operating partners who will ensure the offerings are risk mitigated. It offers the opportunity to sit back and watch your money do the work.

Cash flow is the net income from the rent after paying the mortgage, utilities, and other expenses. We invest in cash flow because it gives you steady income over time. Cash flow can increase year by year because rents will steadily increase while the mortgage stays at the same rate. If your cash flow from real estate is $10,000 and your monthly expenses are $5,000, you are financially free. Our goal is to help investors reach financial freedom.

We will submit your K1 forms to our investor portal in pdf format for you to file.

Cash flow is the best way to determine how well an investment performs. If the cash coming in is consistently more than the money flowing out, it will always provide solid returns; otherwise, it will fail to deliver any returns.

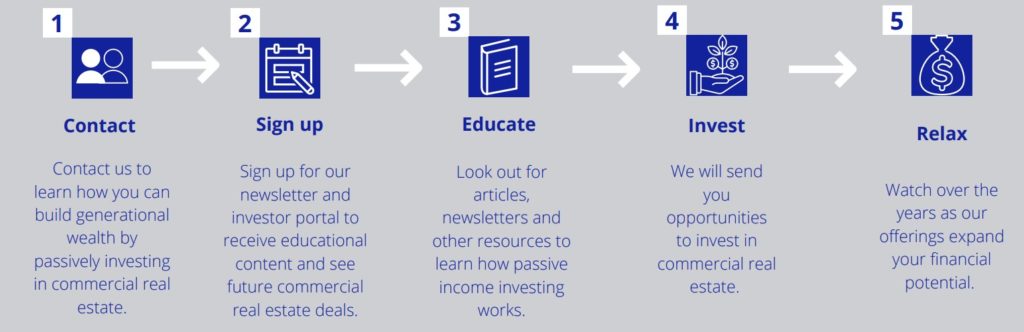

How it Works

1. Schedule a call to learn how you can build generational wealth by passively investing in real estate.

2. Sign up for our newsletter and investor portal to receive educational content and see future commercial real estate deals.

3. We will send you opportunities to invest in commercial real estate.

4. Watch over the years as our offerings expand your financial potential over time.